If You’re Willing to Evolve You Will

The last few weeks have seen several announcements affecting the insurance industry. Economical announced their intent to enter the direct-to-consumer market. Following their own launch of a direct channel, Aviva announced their acquisition of RBC Insurance. Edmonton approved a new bylaw regulating ridesharing, and FSCO approved Aviva’s UberX product. Interesting times.

Regarding the Economical and Aviva announcements, there’s been broad attention and concern throughout our membership, to which we say, we hear you. We encourage you to see the opportunity these changes bring. We’re fully immersed in an era of accessibility. Insurers are acting strategically, not only on the current landscape, but on their predictions for what’s to come.

Across the country, businesses have been pushed to improve and innovate. As IBAO President Doug Heaman confirms, “This is the new reality. Change has happened, is happening and will continue to happen. Customers are asking for, and receiving 24-hour service with access how they choose. Insurers are feeling the pressure to show growth and return on investment, and the broker channel has been slow to respond to changing consumer demands.”

Last week we held conference calls for our membership to discuss broker distribution and market change. Doug Heaman and IBAO Chairman Michael Brattman shared great insight on insurer tactics and broker/channel strategy: “Insurance companies are accelerating the shift in distribution models where digital plays an important role, and brokers are encouraged to refocus and add more value. It’s time to ask yourself what your role as a broker is, and how you’re going to compete in the evolving marketplace.”

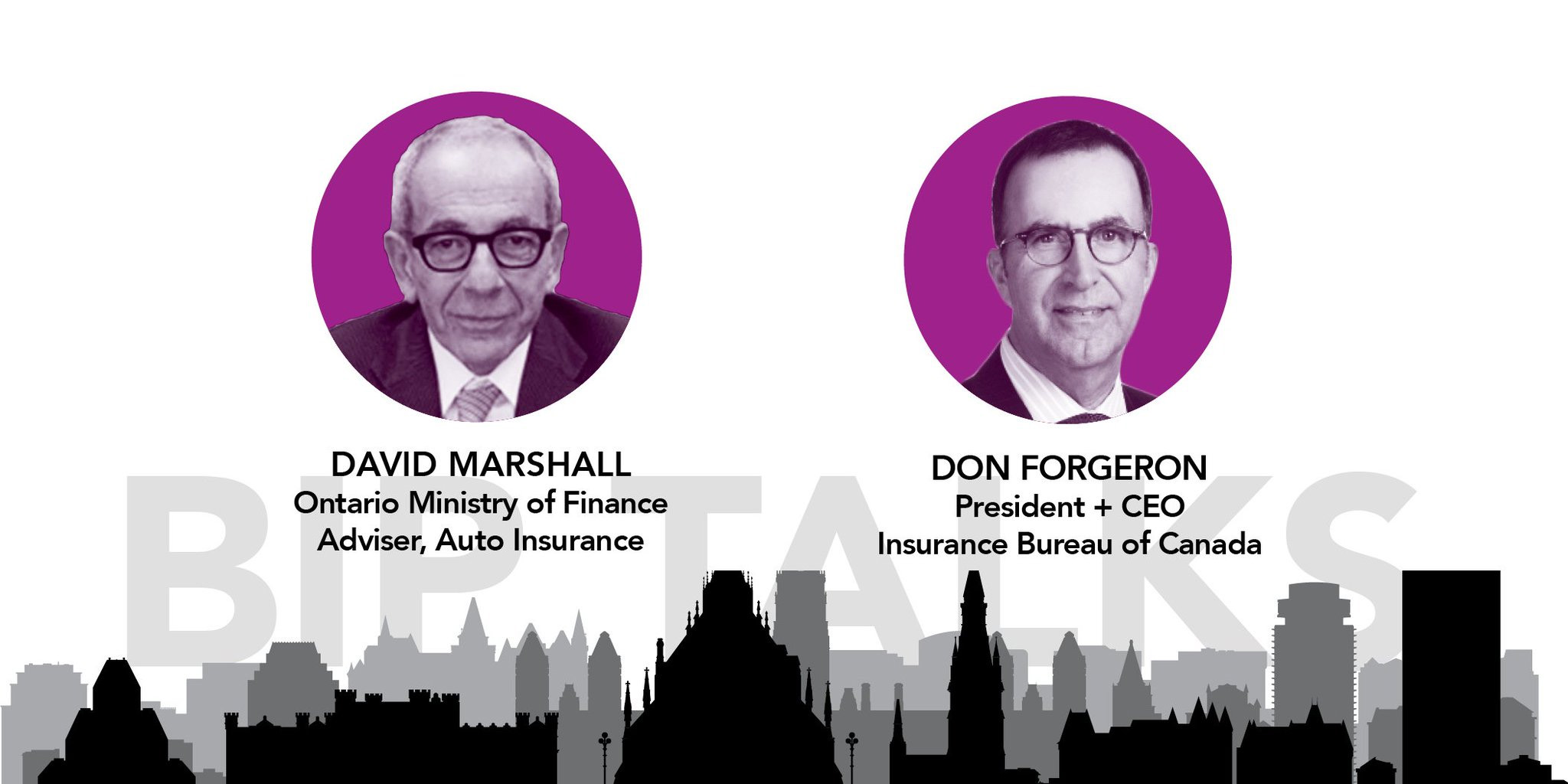

IBAO CEO Jim Murphy noted that as an association, we’re shifting our approach to stronger advocacy and increased communication. Our relationship with insurers is crucial: learning and sharing their plans for future growth; advocating for investment in the broker channel, in technology, innovative products and policy processing; ensuring broker data integrity remains independent and protected; and advocating for fair and reasonable compensation models. Advocacy and open communication are fundamental to the future of these relationships.

“There’s a very bright future for brokers,” Brattman said. “Insurance is a 54 billion dollar industry. 50 percent of consumers get their insurance through the broker channel. It’s a platform more appealing than single product offerings – we have the upper hand by offering choice. The upcoming auto reforms provide brokers an opportunity to connect with their clients and educate them on changes to Optional Accident Benefits coverage.”

As a business, ask yourself who’s helping you grow; think about the companies and partners who truly support you and be strategic in your alliances. All insurers, including those in competing distribution channels are looking for opportunities in the broker channel. “The trend of more choice for consumers is perfectly aligned with our value proposition,” Heaman said. “It’s time to get really clear on what that is for your brokerage – whether it’s a niche, digital or exceptional service play. Brokers who approach their markets with a solid business plan will receive support.”

A key message of last week’s call was growth, with three main points of consideration: going digital, enrolling in IBAO education and capitalizing on upcoming changes to the Ontario Auto product.

Go Digital

Within the next three years, insurers expect brokers to be effectively using digital and social media for marketing, prospecting and lead qualification. Less than 10% of our membership has an active presence on platforms like Twitter, Facebook and LinkedIn. CSIO reports 11% of Ontario brokers don’t have a company website, and only 44% of websites are optimized for mobile devices. On all fronts, we have Affinity Partnerships offering services to help get you where you need to be. Candybox Marketing are experts on everything digital, whether that’s a new website or social media platform; they offer a program called Launch 48 where they plan, build and launch a new website in 48 hours. E-Sign Live by Silanis is a leading electronic signature provider (our membership benefits from reduced pricing). On our member call, Heaman shared: “If you’re unsure how to grow or where to start, look at what your peers are doing, ask about their plans for growth and reach out to the association for guidance. There are a lot of successful digital brokerages in Ontario, and success leaves clues!”

Consider IBAOeducation

We’re here to support you through change. We’re investing in technology to deliver strategic education throughout the year and we’re looking at our two annual events, the Young Brokers Conference in June and the IBAO Convention in October, as platforms to deliver relevant, meaningful education on changing demands and emerging trends. We want to prime you for those moments of truth when you can truly make a difference in people’s lives. If you’re looking for direction on strategy or access to key consumer trends, consider our Beyond Best in Class program: participants consistently outperform their peers in customer engagement and overall performance. Our next offering runs May 10 – 12 and September 27 – 28.

Capitalize on Ontario Auto

If you decide your value is service and advocacy, this round of reforms is the perfect opportunity for consumer engagement. Take advantage of our broker education, consumer brochures and social media campaign, or leverage these tools as inspiration to create a consumer contact strategy of your own.

There will always be a market for advice, knowledge and professionalism, and there’s always going to be value in the brokerage business. The challenge is to maintain growth: “How are you attracting customers?” asked Heaman. “It comes down to technology, marketing strategy and needing to change. Doing the same things you’ve always done won’t get you to tomorrow. Brokers are an entrepreneurial and resilient group. 100 percent of us who choose to win will win.”

Send us your questions and comments on how we can continue to advocate, educate and inspire you – PresidentCall@ibao.on.ca.

Most comments

Winter Tire Discount 101

All

16 comments

When Your Insurance Policy Comes Into Play

All

8 comments

Digital Marketing Trends for Insurance Brokers

All

6 comments