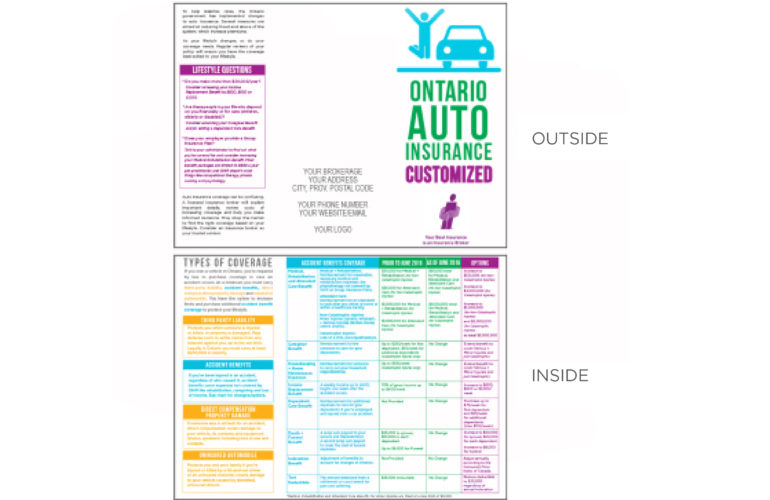

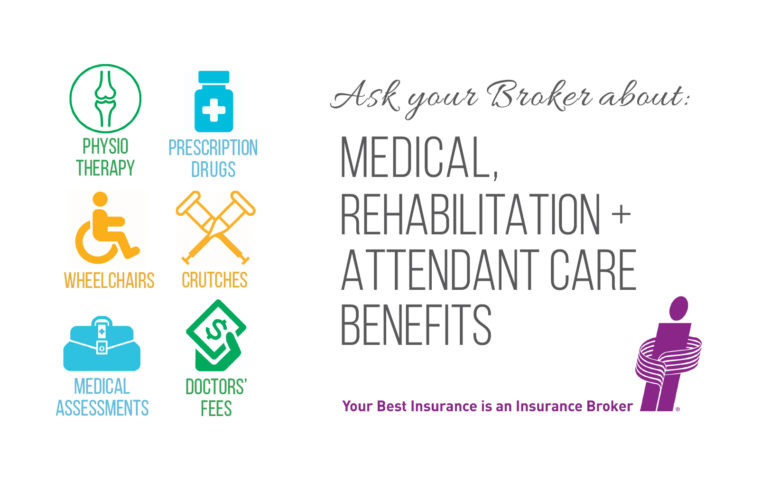

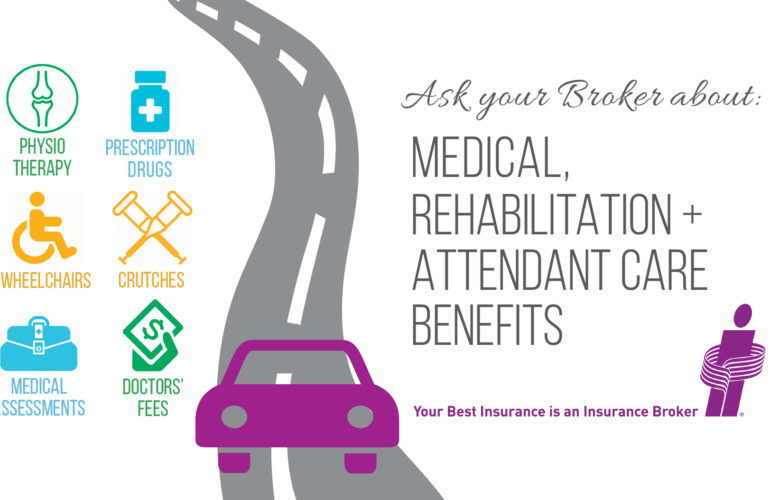

To help stabilize rates, the Ontario government has implemented changes to auto insurance. Several measures are aimed at reducing fraud and abuse within the system, which increase premiums. As of June 1st there will be lower accident benefit limits in standard insurance policies and new options to increase coverage.

* IBAO to Launch Auto Reform Awareness Campaign (Insurance-Canada.ca)

* Brokers must advise clients on changes to auto insurance (Insurance Business)

* Brokers should remain educated on auto insurance changes (Insurance Business)

* Changes to Auto Insurance Policies Will Shrink Coverage (Toronto Star)

* Cheaper Auto Insurance means less coverage for Ontarions (Yahoo Finance)

* Only 42% of Ontarians Aware of Upcoming Auto Insurance Changes (CI Top Broker)

* 42% of Ontarians aware of upcoming auto insurance reforms (Canadian Underwriter)

* Changes coming to auto insurance policies (CTV News London)

* Less than half of Ontarians aware of upcoming auto insurance changes (Insurance Business)